Loan Assist

Can I Take Finance on purchase of Purchase of House / Flat / Commercial property?

Yes you can avail finance, all the properties sold have clear titles and approved by leading financial intuitions.

What are the eligibility criteria for a Housing Loan?

To avail a Home Loan from you must be:

- A Resident Indian

- Above 21 years at the commencement of the loan

- Below 65 / retirement age at the time of maturity

How much loan amount will I be sanctioned?

The maximum loan that can be obtained is 80% of the agreement value however your loan

eligibility will be determined by the bank on the basis of factors such as income, age,

qualifications, number of dependants, spouse's income, assets, liabilities, stability

and continuity of occupation and savings history to ensure easy repayment for you in

the future. The loan eligibility will be subject to the value of property

selected by you.

When can I apply for a loan

You can apply for a loan even before the purchase of the property.

A loan amount will be sanctioned to you based on the above

eligibility criteria. The loan amount will be subject to

the value of the property, when you select one.

What is the maximum tenure of the Loan?

Maximum tenure of the loan is 25 years, subject to eligibility norms.

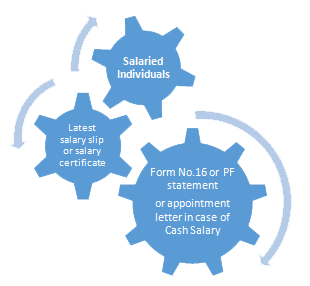

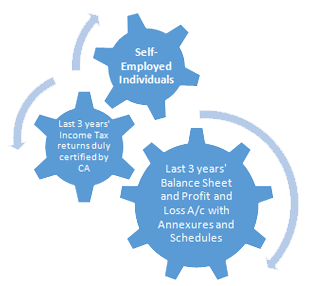

- Any other documents, as may be required

- Passport size photograph

- Identification Proof

- Age Proof

- Bank statement / Pass book copy for last 3-6 months

Documents required may vary*

What security do I need to provide?

The security for the loan is a first mortgage of the property to be financed, normally by way of

deposit of title deeds and/or such other collateral security as may be necessary. The title to the

property should be clear, marketable and free from any encumbrances.Interim security may be

additionally required, if the property is under construction.